Young people are afraid of investing. A Harris poll released in 2016 showed that almost 80% of millennials are not investing in the stock market, missing out on the potential benefits that come with compounding interest by investing early on. Additionally, those millennials who are investing may be making risky moves -- “Three of the top ten most popular stocks on Robinhood [an investing platform geared toward millennials] are Fitbit, GoPro, and Snapchat,” notes Yogi co-founder Gautam (goh-thum) Kanumuru. “All three of those stocks have underperformed the market by an average of 20% over the past year.” A 2015 study of young Canadians found that 82% of them felt that they “[didn’t] have adequate knowledge [for investing].” A Yogi user encapsulated this lack of investing knowledge: “I honestly don't know how to read financial statements and stuff... I just use my gut.”

But according to a study by NerdWallet, a personal finance advising website, that fear of investing is misplaced. Using a Monte Carlo simulation, a commonly used statistical model for calculating risk, NerdWallet estimated that if a 25-year-old saved 15% of the median annual income for that age group ($40,456), they had a 99% chance of recouping that initial investment and a 95% chance to accumulate at least $1.67 million, almost tripling their investment. In comparison, savings accounts analyzed in the same manner had less than a 3% chance to triple their investment. (NerdWallet) “The interest rate that you get at the bank is always less than the inflation rate,” Gautam states. “When you tell people this, they start to listen when you tell them why investing is important for their finances and for their future.”

“Gautam and I met our first year of undergrad at the University of Virginia,” says Yogi co-founder Chad Becker. “We took a lot of the same courses together, and sometime during our second year, we talked about starting a company focused around investing. The prototype we developed around that idea that we thought had the most potential ended up becoming Yogi.”

“I've been investing since I was 13 and Chad has been investing since he was 14,” Gautam chips in. “We’ve actually had times where friends that were getting into investing would pay us for our advice. We would always return the money, but the fact that people found the guidance so useful that they were paying us flipped a switch in our heads that there was an opportunity there.”

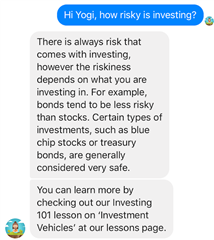

Yogi, the investing tool that Chad and Gautam have created, operates as a chatbot that gives users the opportunity to ask questions or take personalized lessons. The user can view a preset list of questions and lessons or ask their own question. Yogi came from investing tools that Chad and Gautam had built on their own for their personal use. “It started with our own experiences,” explains Chad. “We didn't make those tools because we wanted to. We felt that we had to in order to be competent investors. Once you start earning your first income, you realize that you're going to have to put it away somewhere,” he adds. “And it's not going to be the bank.”

***

The Yogi team sees a problem with the low numbers of younger investors and the high initial barrier to entry required to invest at a competent level. “There are a lot of tools out there to help people learn to invest, but there's a lot of raw data and a lot less on the guidance and usage of that information,” says Gautam. “I think that's what ties us to this problem: the belief that anyone can be good at investing. We want to fill those gaps of knowledge preventing people from getting there.”

The Yogi team sees a problem with the low numbers of younger investors and the high initial barrier to entry required to invest at a competent level. “There are a lot of tools out there to help people learn to invest, but there's a lot of raw data and a lot less on the guidance and usage of that information,” says Gautam. “I think that's what ties us to this problem: the belief that anyone can be good at investing. We want to fill those gaps of knowledge preventing people from getting there.”

To expand the scope of Yogi, Chad and Gautam are figuring out how to incorporate different topics outside of investing. “Yogi's chat interface makes it easy for users to ask specific questions and get relevant answers that they need. However, it's also simple enough that you can plug in whatever material you want into it across different subjects,” Gautam says. “In the future, we're hoping to make this available across a wider set of educational topics, such as personal finance. We can unplug the investing material and potentially plug in anything. The hope is that Yogi will be another way of learning that people are interested in, especially for those who learn best in a casual, ‘learn on your own time’ environment.”

To expand the scope of Yogi, Chad and Gautam are figuring out how to incorporate different topics outside of investing. “Yogi's chat interface makes it easy for users to ask specific questions and get relevant answers that they need. However, it's also simple enough that you can plug in whatever material you want into it across different subjects,” Gautam says. “In the future, we're hoping to make this available across a wider set of educational topics, such as personal finance. We can unplug the investing material and potentially plug in anything. The hope is that Yogi will be another way of learning that people are interested in, especially for those who learn best in a casual, ‘learn on your own time’ environment.”

***

On their work and experiences on their venture so far at the iLab this summer, the Yogi founders had a lot to discuss. “Something Gautam and I said recently is that there’s no way we’ll be able to go back to a traditional 9 to 5 job at a big company after this summer,” says Chad. “Working on Yogi has reinforced with us that even with all this uncertainty and risk, thriving in all of that is just in our nature. Jumping into this full-time and making that leap made us really understand that.”

“For me, this summer has reinforced some things that were just ideas or concepts,” says Gautam. “Something that I've always heard was, ‘Oh, just work hard, manage your time, put in the effort, and it will all come together.’ And I think it's one of those things where you really have to go out and do it rather than hear it from someone else for it to really impact your life. It’s been a similar experience with what you always hear about entrepreneurs; how founders need to be able to think on their feet, adapt to new situations, all that jazz. I always read about that and had an appreciation for the ideas, but now that I've gone through it myself, I have a fundamental understanding as to why those traits are important.”

“All these validations have been super cool,” Gautam concludes. “Getting into the iLab was a huge win for us. Hearing from the people who have tried out the beta… even the fact that they’re willing to chat is so rewarding for us. The skills I’ve picked up working on Yogi -- learning what it takes to operate a company and what the most successful and best practices are -- I know for a fact that they’ll come in handy.”

***

To explore the capabilities of Yogi, you can learn more here, and you can contact the team at founders@meetyogi.com.

About The Team

Gautam Kanumuru (left) received a B.S. in Computer Engineering from the University of Virginia in 2015. He has worked as a Program Manager for Microsoft and held the positions of Software Engineer and VP of Engineering at Clarke.ai, an artificial intelligence system that analyzes conversations. Gautam has also volunteered as a computer science instructor as well as a basketball coach through the Boys and Girls Club.

Gautam Kanumuru (left) received a B.S. in Computer Engineering from the University of Virginia in 2015. He has worked as a Program Manager for Microsoft and held the positions of Software Engineer and VP of Engineering at Clarke.ai, an artificial intelligence system that analyzes conversations. Gautam has also volunteered as a computer science instructor as well as a basketball coach through the Boys and Girls Club.

Chad Becker (right) received a B.S. in Electrical Engineering from the University of Virginia in 2015. Chad has worked extensively with Lockheed Martin in software engineering and project engineering capacities. He has also worked as a content marketer for solar power company Swan Solar.

Chad Becker (right) received a B.S. in Electrical Engineering from the University of Virginia in 2015. Chad has worked extensively with Lockheed Martin in software engineering and project engineering capacities. He has also worked as a content marketer for solar power company Swan Solar.